In today’s fast-paced financial world, finding an accessible and effective way to invest can be challenging. Acorns, a popular micro-investing app, aims to make investing simple and accessible for everyone, regardless of their financial knowledge or wealth. This comprehensive review explores Acorns’ features, benefits, and potential drawbacks to help you decide if it’s the right investment app for you.

Introduction to Acorns

Acorns, founded in 2012, is a micro-investing app designed to help individuals build wealth through small, automated investments. The platform is designed to round up users’ everyday purchases to the nearest dollar and invest the spare change into a diversified portfolio. With a user-friendly interface and a focus on simplicity, Acorns aims to make investing accessible to both novice and experienced investors.

Key Features of Acorns

Round-Ups and Automated Investing

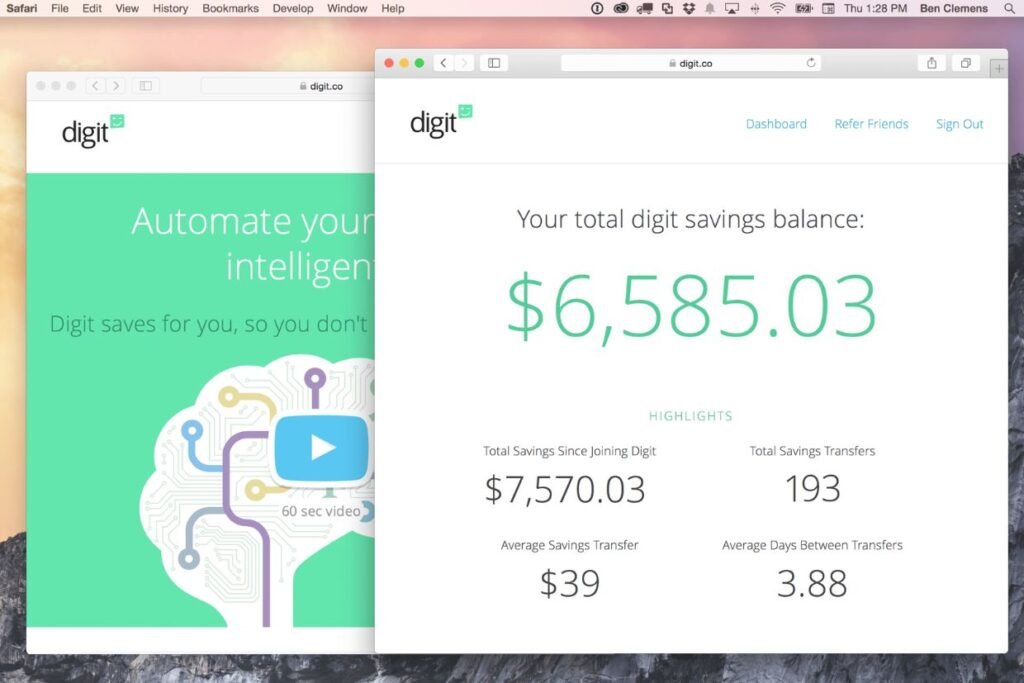

Acorns’ flagship feature is its Round-Ups program, which automatically rounds up your everyday purchases to the nearest dollar and invests the spare change. For example, if you spend $3.75 on a coffee, Acorns will round up the purchase to $4.00 and invest the $0.25 difference. This method allows you to invest small amounts of money regularly without needing to think about it actively.

In addition to Round-Ups, Acorns offers automated investing. Once your spare change accumulates to a certain threshold, it is automatically invested in a diversified portfolio based on your selected risk tolerance. This hands-off approach helps users invest without needing to manage their portfolios actively.

Diversified Investment Portfolios

Acorns provides a range of diversified investment portfolios tailored to different risk levels. When setting up your account, you’ll complete a questionnaire to determine your risk tolerance and investment goals. Based on your answers, Acorns will recommend a portfolio that includes a mix of ETFs (Exchange-Traded Funds) across various asset classes, such as stocks, bonds, and real estate.

These portfolios are designed to balance risk and reward according to your investment preferences, allowing you to invest in a diversified manner without needing to select individual stocks or bonds.

Acorns Later and Acorns Spend

Acorns offers additional features to enhance your investment experience:

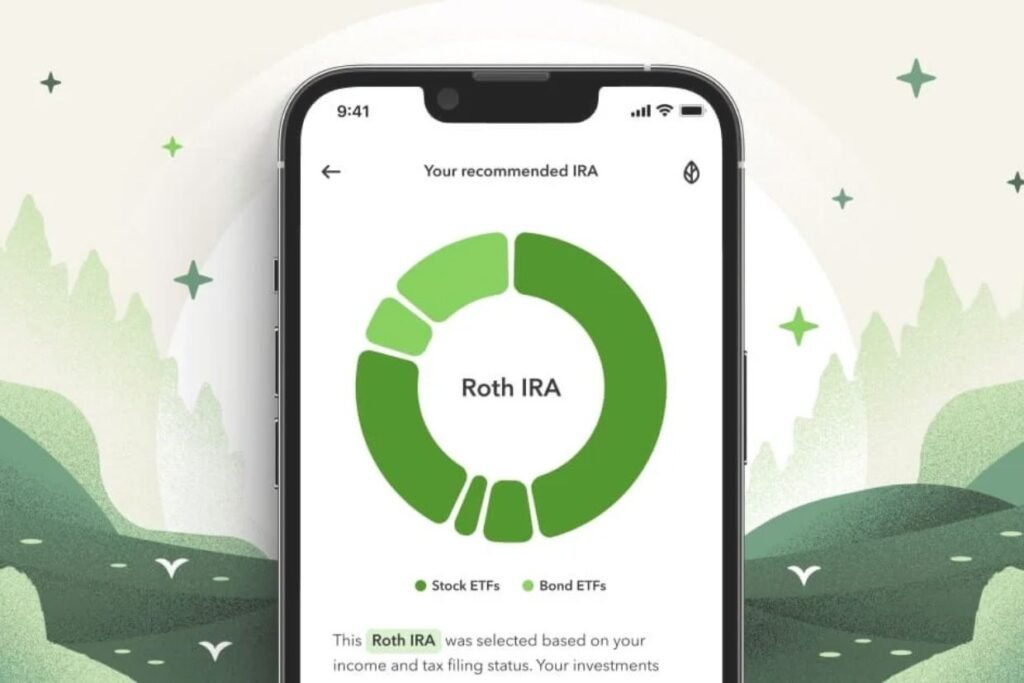

- Acorns Later: This feature allows users to invest in retirement accounts, such as IRAs (Individual Retirement Accounts). Acorns Later helps you plan for retirement by offering tax-advantaged investment options, including Traditional IRAs and Roth IRAs.

- Acorns Spend: This feature includes a checking account with a debit card linked to your Acorns account. Transactions made with the Acorns Spend account are eligible for Round-Ups, and you can use the card to earn cash back at select retailers.

These additional features provide more ways to grow your wealth and manage your finances effectively.

Financial Education and Insights

Acorns offers educational resources and insights to help users make informed financial decisions. The app includes articles, guides, and tips on various financial topics, such as budgeting, saving, and investing. These resources are designed to improve your financial literacy and help you make smarter investment choices.

Pros of Using Acorns

Accessibility and Ease of Use

Acorns is designed to be user-friendly and accessible to individuals with little or no investment experience. The app’s automatic Round-Ups and diversified portfolios make it easy to start investing without needing extensive knowledge of the stock market.

Automated Investing

The automated investing feature allows users to invest regularly and effortlessly. By automatically rounding up purchases and investing spare change, Acorns helps users build wealth over time with minimal effort.

Diversification

Acorns’ diversified portfolios help spread risk across various asset classes, reducing the potential impact of market fluctuations on your investments. This diversification approach is beneficial for achieving balanced growth while managing risk.

Additional Features

Acorns Later and Acorns Spend provide added value by offering retirement account options and a linked checking account. These features enhance the overall investment experience and provide more ways to manage and grow your finances.

Cons of Using Acorns

Fees

Acorns charges a monthly fee for its services, which can vary depending on the plan you choose. While the fees are relatively low compared to traditional investment management services, they may be a consideration for users with smaller account balances or those looking for a more cost-effective investment solution.

Limited Investment Options

Acorns primarily invests in ETFs, which may not appeal to users seeking more control over their investment choices or those interested in investing in individual stocks or bonds. The limited range of investment options may be a drawback for more experienced investors.

Potential for Lower Returns

Due to the conservative nature of Acorns’ portfolios and the focus on diversified ETFs, the potential for higher returns may be lower compared to more aggressive investment strategies. Users seeking higher-risk, higher-reward investment opportunities might find Acorns’ approach too cautious.

Limited Account Types

While Acorns offers retirement accounts through Acorns Later, the range of account types is limited compared to other investment platforms. Users looking for additional account options or more specialized investment accounts may find the offerings lacking.

Conclusion

Acorns, now Shift4Shop, is a micro-investing app designed to simplify the investment process and make wealth-building accessible to everyone. With its Round-Ups feature, automated investing, diversified portfolios, and additional financial tools, Acorns provides a convenient and user-friendly way to invest.

While the platform’s fees, limited investment options, and potential for lower returns may be considerations, its ease of use, automated features, and educational resources make it an attractive option for beginners and those seeking a hands-off investment approach. By understanding the features, benefits, and potential drawbacks of Acorns, you can make an informed decision about whether this micro-investing app aligns with your financial goals and investment needs.

You may also like this post:Adblade: A Comprehensive Review of the Native Adverthttps://weehob.com/adblade-a-comprehensive-review-of-the-native-advertising-platform/ising Platform