In today’s fast-paced world, managing your finances effectively is crucial for achieving financial stability and growth. Credit Karma is a popular platform that offers a range of tools and resources to help users take control of their financial health. In this comprehensive guide, we will explore the features, benefits, and tips for using Credit Karma to manage your finances.

What is Credit Karma?

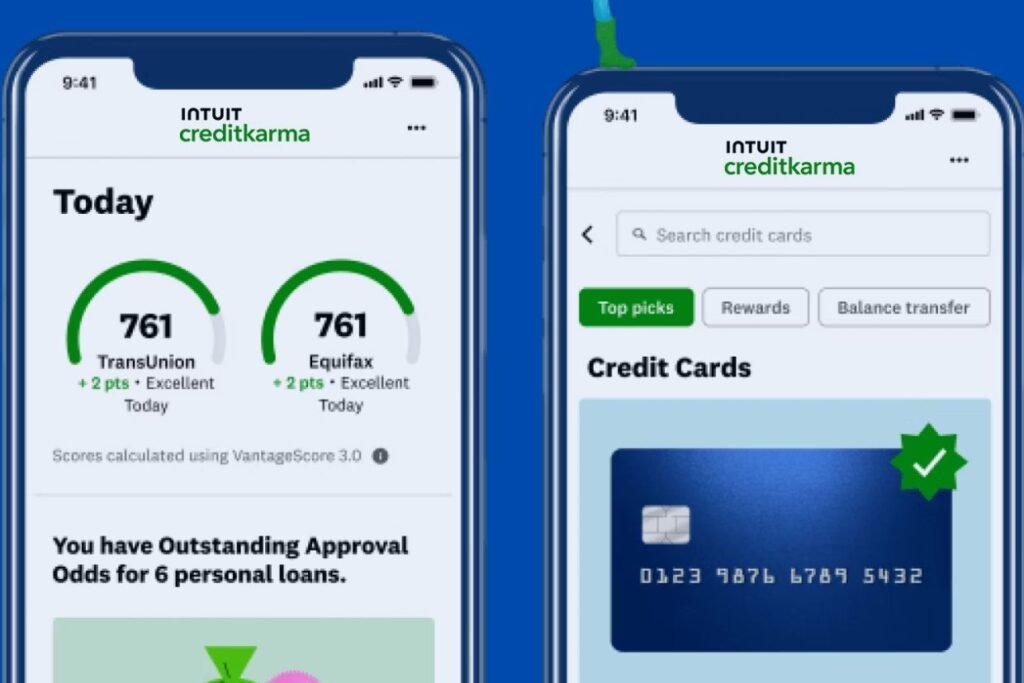

Credit Karma is a free online service that provides users with access to their credit scores, credit reports, and personalized financial recommendations. Founded in 2007, Credit Karma aims to help consumers understand and improve their financial health by offering a suite of tools and educational resources.

Key Features of Credit Karma

Credit Karma offers a variety of features designed to help users manage their finances effectively. Here are some of the key features:

1. Free Credit Scores and Reports

Credit Karma provides free access to your credit scores from TransUnion and Equifax, two of the major credit bureaus. Users can also access their credit reports, which offer detailed insights into their credit history.

2. Credit Monitoring

The platform offers free credit monitoring services, alerting users to any significant changes in their credit reports. This feature helps users stay on top of their credit and detect potential fraud early.

3. Personalized Recommendations

Credit Karma provides personalized financial recommendations based on your credit profile. These recommendations include credit card offers, loan options, and other financial products that may help you save money and improve your financial health.

4. Financial Tools

Credit Karma offers a range of financial tools to help users manage their finances. These tools include a loan calculator, a credit score simulator, and budgeting tools.

5. Tax Filing Services

In addition to credit monitoring, Credit Karma offers free tax filing services through Credit Karma Tax. This service helps users prepare and file their federal and state tax returns at no cost.

Benefits of Using Credit Karma

Using Credit Karma to manage your finances comes with several benefits:

1. Cost-Free Access

One of the most significant benefits of Credit Karma is that it provides free access to your credit scores, reports, and monitoring services. This allows users to stay informed about their credit health without incurring any costs.

2. Improved Financial Awareness

Credit Karma helps users become more aware of their financial situation by providing detailed insights into their credit profiles. This awareness is crucial for making informed financial decisions and improving credit health.

3. Fraud Detection

With its credit monitoring services, Credit Karma helps users detect potential fraud early. By receiving alerts about significant changes in their credit reports, users can take prompt action to protect their financial health.

4. Personalized Advice

The platform’s personalized recommendations are tailored to each user’s credit profile, helping them find financial products that suit their needs and improve their financial situation.

5. Convenient Tax Filing

Credit Karma Tax offers a convenient and cost-free way to prepare and file your taxes. This service simplifies the tax filing process and ensures users take advantage of all available deductions and credits.

Tips for Using Credit Karma Effectively

To get the most out of Credit Karma, consider the following tips:

1. Regularly Check Your Credit Scores and Reports

Make it a habit to regularly check your credit scores and reports on Credit Karma. This practice will help you stay informed about your credit health and identify any discrepancies or issues that need attention.

2. Utilize Credit Monitoring Alerts

Pay attention to the credit monitoring alerts provided by Credit Karma. These alerts can help you detect potential fraud early and take prompt action to protect your financial health.

3. Take Advantage of Personalized Recommendations

Explore the personalized financial recommendations offered by Credit Karma. These suggestions can help you find credit cards, loans, and other financial products that are best suited to your needs and goals.

4. Use Financial Tools

Leverage the financial tools available on Credit Karma, such as the credit score simulator and budgeting tools. These tools can help you plan and manage your finances more effectively.

5. File Your Taxes with Credit Karma Tax

Consider using Credit Karma Tax to file your taxes. This free service can simplify the tax filing process and help you maximize your deductions and credits.

Conclusion

Credit Karma is a powerful tool for managing your finances and improving your financial health. With its free access to credit scores, reports, and monitoring services, along with personalized recommendations and financial tools, Credit Karma provides a comprehensive solution for taking control of your financial future

You may also like this post: Daily Steals Review: Great Deals or Just Hype?